Projects

Where we Operate

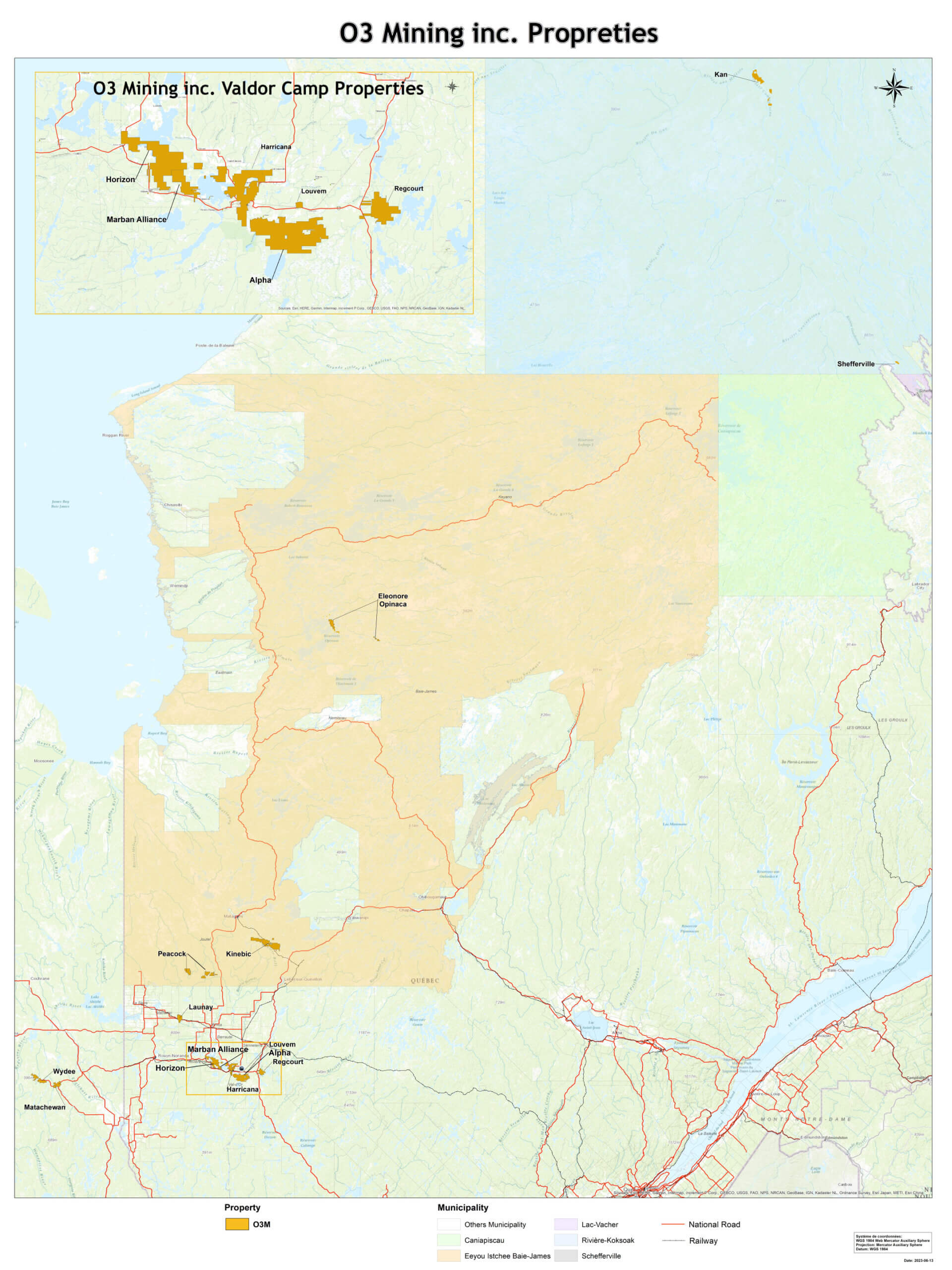

O3 Mining has a portfolio of assets in Val-d’Or, Quebec, spanning more than 65,000 hectares. Our projects host 2.86 million gold ounces of M&I resources at 1.18 g/t Au, and 0.77 million gold ounces of inferred resources at 3.04 g/t Au.

Overview

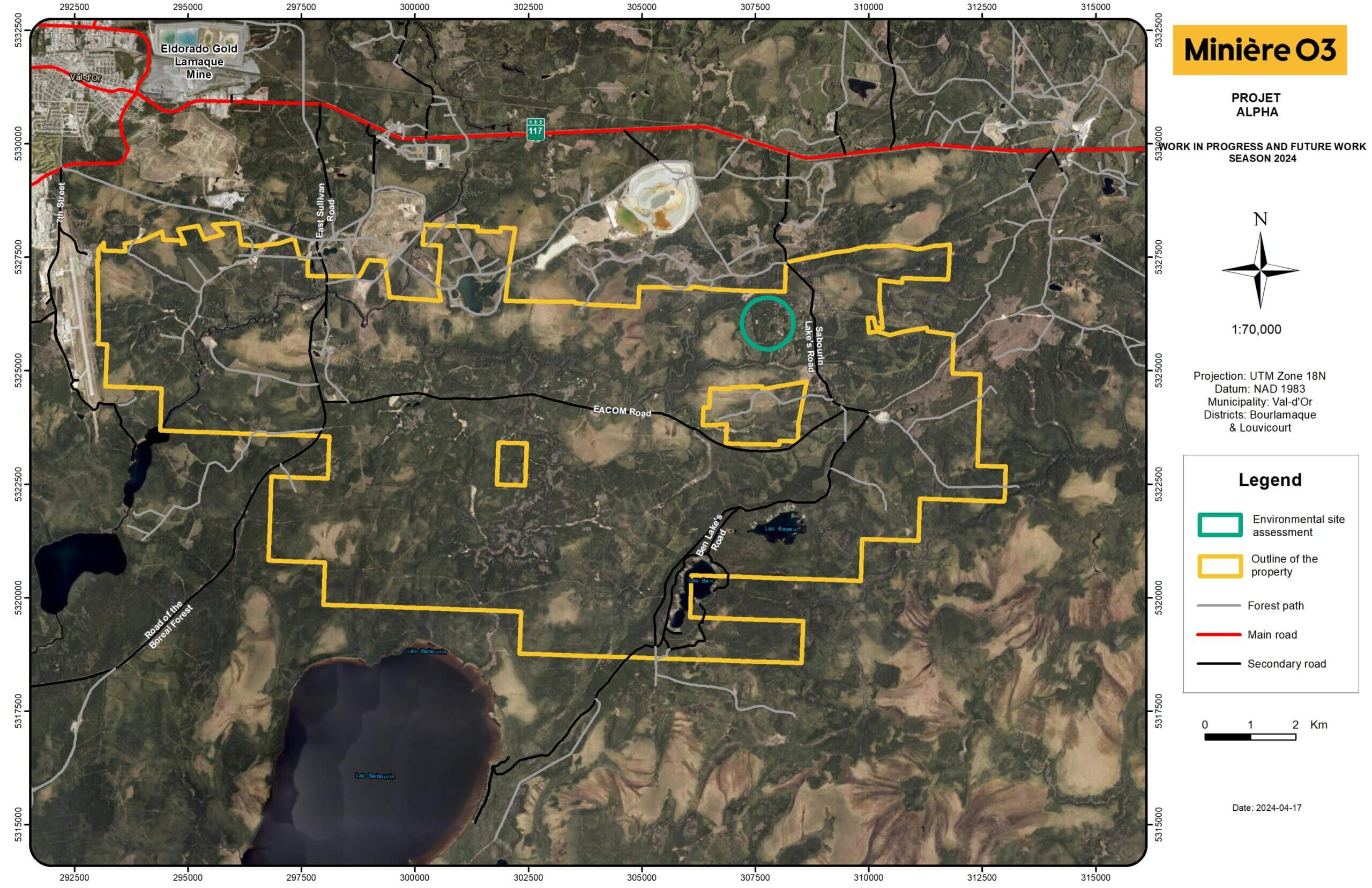

The Alpha Property is located in the Abitibi region, in the Bourlamaque and Louvicourt Townships, approximately 8 kilometres southeast of the city of Val-d’Or in the province of Québec, Canada, directly south of the Eldorado’s Lamaque mine. The Alpha Property, an amalgamation of several historical properties, totals 321 contiguous claims for 12,077 ha. O3 Mining owns 100% of the claims of the Alpha Property, except for six (6) claims forming the Centremaque Block, which is held 80% by O3 Mining and 20% by Golden Valley. Various NSR royalties are in place with previous owners.

The Alpha Property has a long history of exploration that started in the 1920s. Before being consolidated by O3 Mining in 2019, the Property was divided into multiple smaller properties, which were prospected by several companies over the past decades. Historical exploration work on the Property included geophysical surveying, geochemical programs, geological and structural mapping, trenching, sampling, reverse circulation drilling, and diamond drilling from surface and underground.

High-resolution and modern aeromagnetic surveys covering the property were completed in 2011 by Alexandria Minerals. Induced polarization surveys on the property were among Alexandria’s exploration activities. A MEGATEM airborne electromagnetic system was conducted to explore for sulphide-related mineralization. A downhole InfiniTEM XL survey was also conducted west of the Simkar mine in the Anamaque property area. The O3 drilling database contains 3,211 diamond drill holes totalling 706,748 metres which captures nearly a century of drilling information from 1929 to 2022. Three historical mineral resource estimates have been prepared for the deposits on the Alpha Property, supported by NI 43-101 technical reports:

Deposit Scenario Category Tonnes (kt) Gold (g/t) Ounces (koz) Akasaba Open Pit (0.5 g/t cut-off) Indicated 3,009 1.37 132.5 Inferred 285 1.76 16.1 Underground (2.25 g/t cut-off) Indicated 654 5.79 121.7 Inferred 1,538 5.51 272.4 Simkar Underground (3.0 g/t Au cut-off) Measured 34 4.71 5.1 Indicated 208 5.66 37.9 Inferred 98 6.36 20.1 Orenada Open Pit (0.4 g/t cut-off) Indicated 3,563 1.54 176.1 Inferred 1470 1.38 65.1 Underground (2.0 g/t cut-off) Indicated 191 3.0 18.4 Inferred 609 3.12 61.1 Geology and Mineralization

The Alpha Property is situated in the Val-d’Or mining district within the Precambrian Canadian Shield of western Quebec. Rocks of the Val-d’Or gold district belong to the Archean Abitibi greenstone belt of the Superior Province, Quebec. The Abitibi greenstone belt consists of east-trending alternating volcanic, plutonic and sedimentary belts bounded by crustal-scale faults. The Alpha Property is located at the junction of the Abitibi and Pontiac subprovinces and covers over a 20-kilometre-long portion of the Cadillac–Larder Lake Fault Zone (“CLLF”) directly southeast of the Val-d’Or mining camp.

Two principal sub-types of orogenic gold mineralization have been identified on the Alpha Property. At the Orenada deposit, shear-hosted mineralization consists of quartz–tourmaline–albite–carbonate veins and veinlets within mafic and intermediate rocks, with a low sulphide content (<2%). Arsenopyrite is closely associated with gold mineralization. At the Bulldog deposit, mineralization is associated with broader zones of deformation and alteration, with sericitization and disseminated pyrite as the main indicators for gold mineralization hosted in felsic dykes.

In addition to the shear zone-hosted gold mineralization, intermediate to felsic intrusions can be prospective host units and exhibit different alteration minerals due to the chemical interaction between mineralizing fluids and the host rocks. This type of mineralization tends to be associated with quartz–carbonate–tourmaline veins surrounded by albite alteration halos. They are similar to the vein systems found at the Sigma-Lamaque and Goldex mines in the Val-d’Or mining camp.

Finally, gold-copper deposits of skarn and porphyry types are found within mafic volcanic and intrusive rocks proximal to the edges of the multiphased East Sullivan and Callahan plutons. Akasaba West is the main deposit of this type. Cu±Au±Mo skarn and porphyry style mineralization is dominant at both Akasaba and East Sullivan Rim and represents the more atypical examples of gold mineralization in the Val-d’Or mining camp. Bigot (2021) identified a number of gold deposits surrounding the East Sullivan stock that exhibit Cu±Au±Mo affinities with high sulphide contents and calc-silicate assemblages (Ca-amphibole, epidote, and carbonate ± magnetite). Garnets are also frequently noted, leading to the interpretation that the Akasaba and East Sullivan deposits can be potentially classified as skarn deposits and co-exist with orogenic deposits such as Orenada and Bulldog.

Exploration by O3 Mining

Since its involvement in the property, O3 Mining has carried out Induced Polarization geophysical surveys, outcrop stripping and mapping, exploration targeting by using artificial intelligence (AI) algorithms and sunk 303 diamond drill holes totalling 126,838 metres. O3 Mining completed the outcrop stripping campaign during the fall of 2020. The work focused on the Sabourin, Valdora and Simkar areas to characterize and discover new skarn mineralization systems and quartz tourmaline veins systems.

In November 2022, O3 Mining published a maiden inferred resource estimate for the Bulldog and Kappa deposits. This estimate includes approximately 50,000 metres of drilling in 116 holes, including 42,817 metres in 88 holes completed by O3 Mining from September 2019 to April 2022. Much of the estimated tonnage related to the Bulldog deposit is contained in three stacked zones within a 75-metre-wide corridor starting at surface and covering an area of 620 metres vertical by 360 metres wide. The true thickness of the Bulldog zones varies from 2 to 10 metres. The resources related to the Kappa zones are distributed in two sub-vertical shoots starting at 60 metres and 560 metres vertical, respectively, each covering an area of approximately 200 metres long by 100 metres wide. The Kappa horizon is 175 metres north of the Bulldog trend. The Bulldog resource contains 270,000 oz Au at 3.2 g/t Au, and Kappa contains 48,000 oz Au at 3.7 g/t Au.

O3 Mining has obtained many significant drill intercepts outside of the mineral deposits. A good number of those remain open and therefore warrant follow-up drilling. For instance, Sigma-type gold-bearing veins cut in a diorite plug on the Centremaque claims returned 5.8 g/t Au over 1.5 m (O3AL-20-303A) and 1.5 g/t Au over 5.7 m, including 5.3 g/t Au over 0.5 m (O2AL-21-353-W1). The Kappa deposit remains open in many directions, with intercepts of 12.0 g/t Au over 8.3 m (O3AL-21-388) and 4.4 g/t Au over 4.1 m (O3Al-21-338). The 2023 drill program will test the extensions of these intercepts.

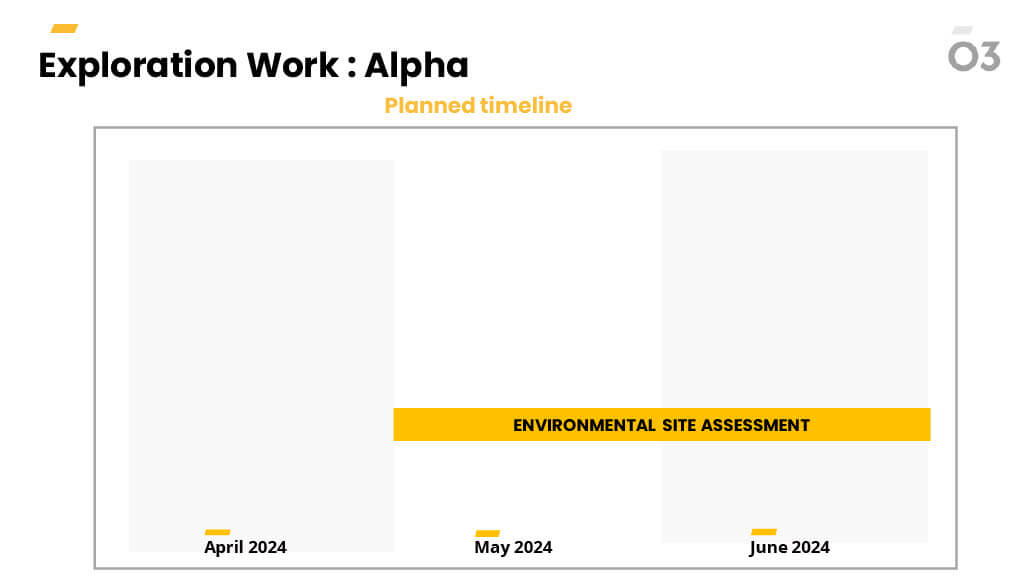

Localization and timing of planned work

Overview

The information is coming soon

Geology and Mineralization

The information is coming soon

Exploration by O3 Mining

The information is coming soon

Localization and timing of planned work

Overview

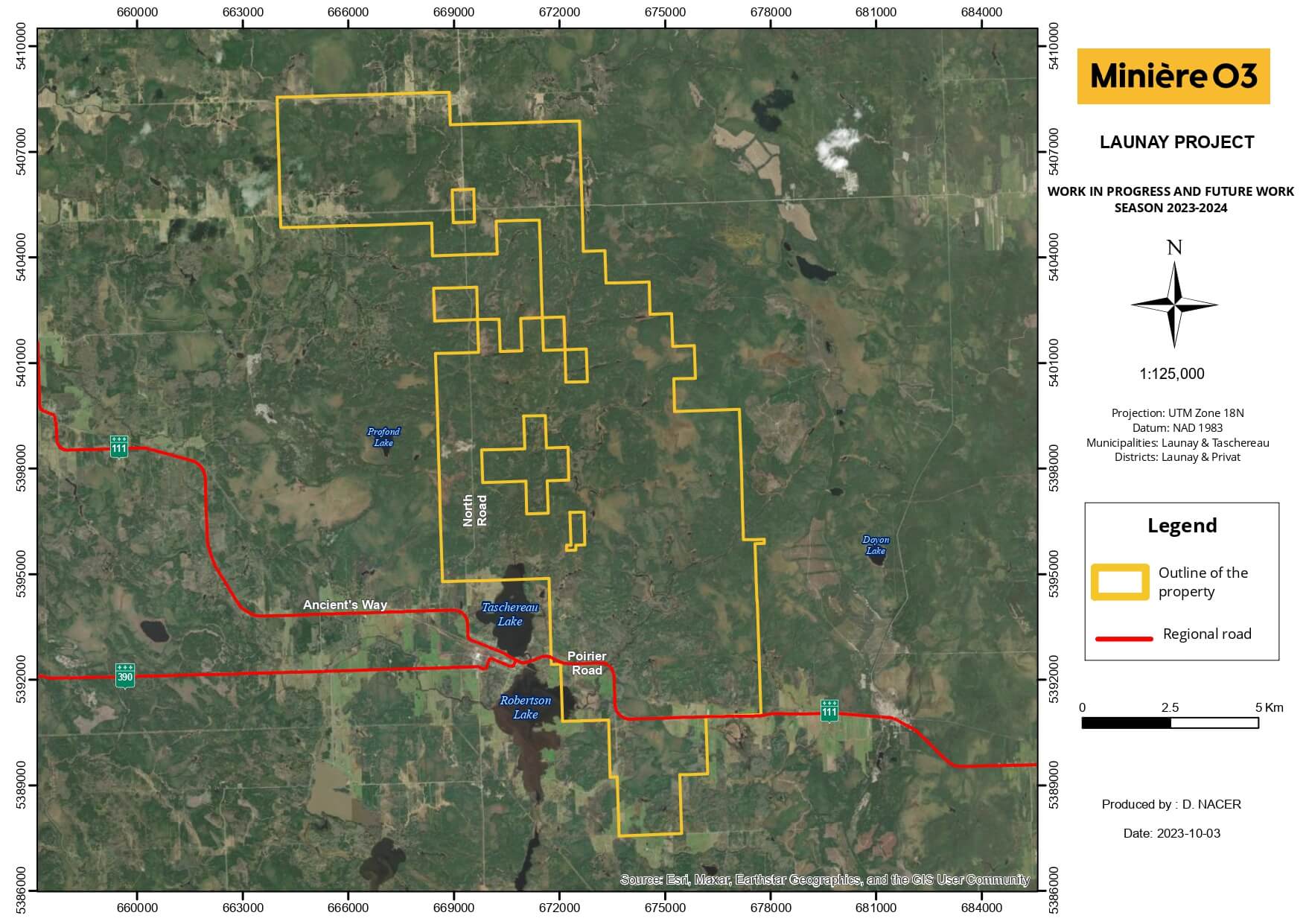

The Launay property is located near the villages of Taschereau and Launay in southern Abitibi, 55 km NNE of Rouyn Noranda. It consists of 103 claims covering an area of 3,928 hectares. Access to the property is via an old trail connected to Highway 111, which crosses the property from west to east. The main trail leads to the top of the hill that formed Zone 75.

The property has been explored and mapped since the 1930’s. However, most of the exploration work (including trenching, stripping, drilling and geophysical surveys) were done in the 1980’s and 1990’s by Messeguay Mines. More than 200 holes were drilled systematically through the whole property, focussing mainly on Zone 75, Zone Principale and Zone 53. In 1988 Messeguay published a mineral resource for Zone 75 containing 29,500 oz Au at 3.6 g/t Au in indicated category and 33,246 oz Au at 3.3 g/t Au in the inferred category. Furthermore, Melkior conducted exploration work from 2012 to January 2014 included 28 diamond drill holes, metallurgical testing and surface work such as channeling and grab sampling. The property was subsequently acquired by Beaufield, which was then acquired by Osisko Mining and spun off into O3 Mining. A total of 37,410 metres of diamond drilling distributed over approximately 227 DDHs has been conducted on the Launay property.

Geology and Mineralization

The bedrock of the Launay property consists of felsic intrusive rocks of the Launay Pluton and Taschereau Batholith, mainly granodiorite and granite with various alteration. The main alteration includes epidote, potassic (biotite and potassic feldspar), albite, hematite, carbonate and sericite. Gold is associated with disseminated pyrite mineralization within albite-rich and/or potassic altered granite. Gold values are typically between 1.0 and 5.0 g/t Au in these zones. Locally, fracturing is developed within the albite-rich altered zones and gold seems to be more concentrated, typically above 5.00 g/t. Gold is also associated with quartz veins, especially on Zone Principale. Quartz and feldspar porphyry intrusions as well as mafic breccia-dykes occur which represent local marker horizons through the property.

At the property scale, gold mineralization seems to be concentrated at the intersection of NNE to NE structures with a crescent shape magnetic high extending over more than 5 km. Outside of the main mineralized area, several-showings located in similar intersections remain to be fully explored.

Exploration by O3 Mining

O3 Mining initiated compilation work in preparation for an initial summer field season aiming at understanding the mineralization context and assessing the potential to grow the mineral resources of the property.

Localization and timing of planned work

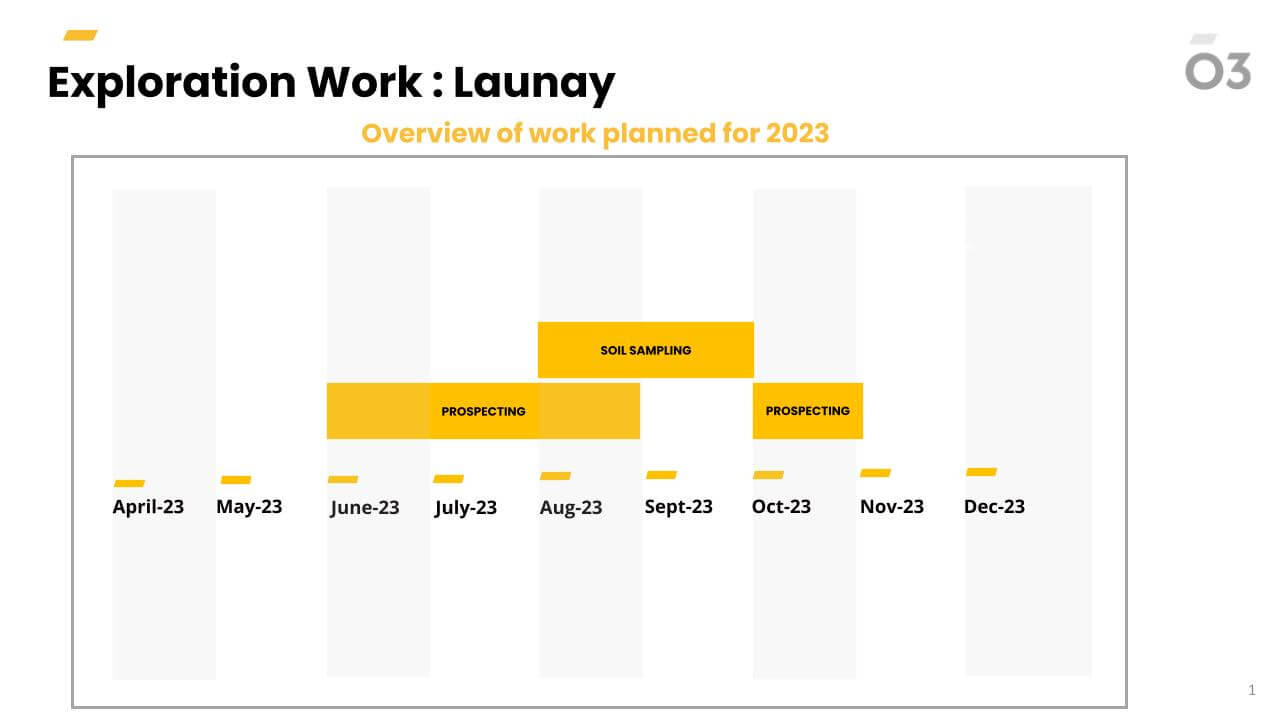

Planned timeline for 2023

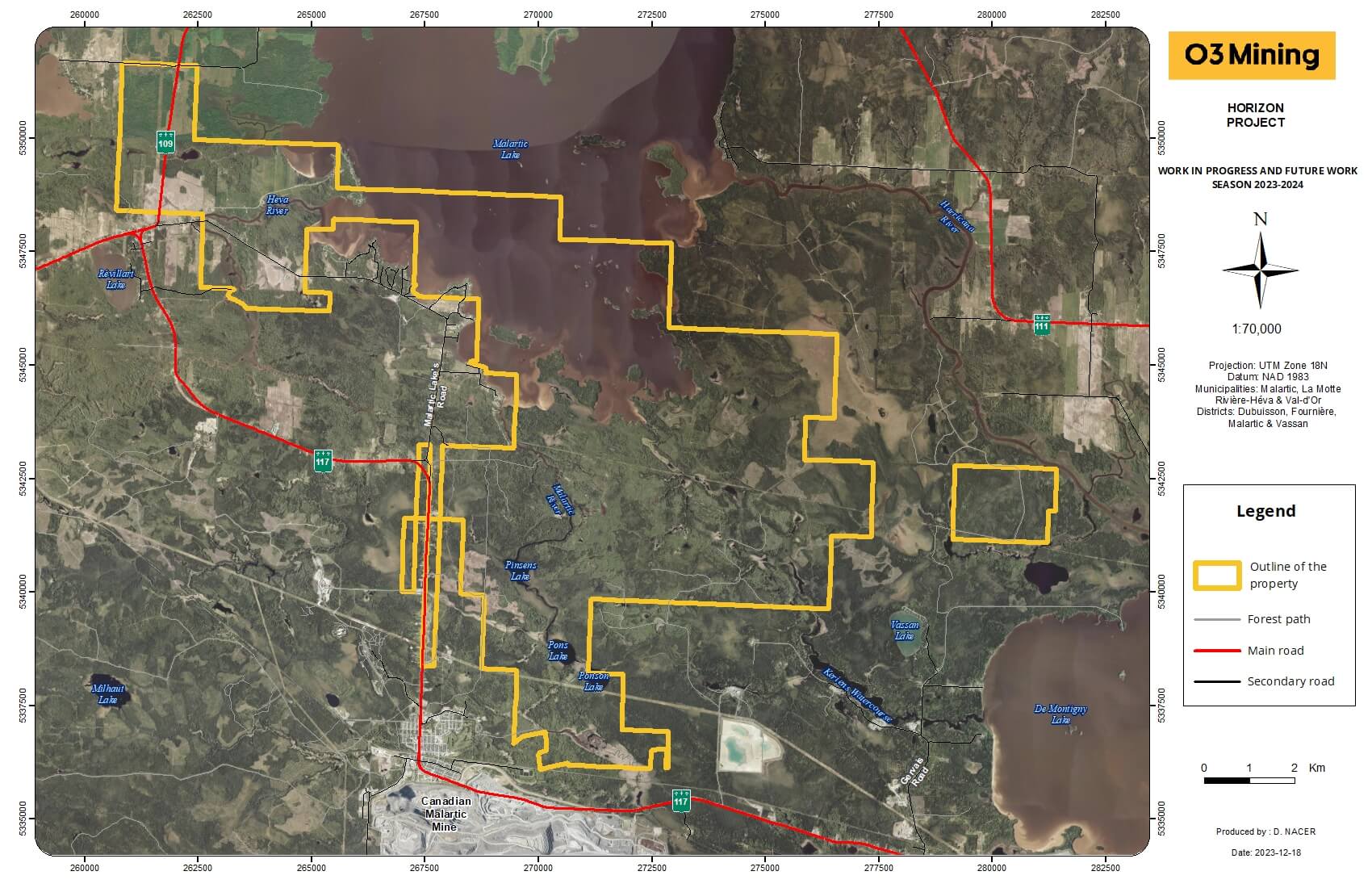

Overview

The Horizon property is located directly to the northwest of Marban Alliance. It comprises 192 claims covering 8,778 hectares, contiguous with Marban Alliance. The exploration stage at Horizon is less advanced than Marban Alliance, even though it covers the traces of the prolific Marbenite and Norbenite shears. Historically, the companies that explored Horizon are the same ones that explored Marban Alliance. NioGold’s drilling was more systematic and covered the interpreted extensions of the Marbenite and Norbenite shears at spacings varying between 400 to 800 metres.

Geology and Mineralization

The Horizon property is located in the southern portion of the Archean Abitibi greenstone belt, where the Parfouru fault separates the Blake River segment to the west from the Malartic segment to the east (Daigneault et al., 2002). The western portion of the property contains the eastern end of the Blake River Group, which manifests as a north-dipping panel with faulted contacts bordered by the sedimentary units of Kewagama to the north and Cadillac to the south (De Souza et al., 2020). The local geology and mineralization styles at Marban Alliance extend onto the Horizon property over approximately 7 kilometres. Notable intercepts from NioGold in this sector include 1.0 g/t Au over 5.1 m (CW-10-013) and 0.2 g/t Au over 30.4 m (CW-10-012) on the W Zone, some 1.5 kilometres northwest of the Malartic H deposit. Additionally, the Horizon property covers the Parfouru and La Pause gold-bearing shears located south and north of the Kewagama sedimentary basin, respectively. The La Pause corridor hosts the historical Camflo mine that produced 1.9 M oz Au at 5.3 g/t Au. Significant intercepts by NioGold along those corridors include 8.2 g/t Au over 3.1 m (CW-11-021), 23.4 g/t Au over 1.0 m (CW-12-083) and 9.1 g/t Au over 2.2 m (CW-12-075). The latter was intersected in a mineralized envelope that returned 0.6 g/t Au over 49.1 m starting at surface.

Exploration by O3 Mining

A high-resolution drone mag survey was completed in March 2022 over most of Horizon with flight lines spaced at 50 metres for a total of 712 linear-kilometres. It was merged with a historical Marban Alliance heliborne mag survey completed by NioGold. A soil geochemistry survey was completed in 2022 (4,411 samples), as well as mapping and channel sampling on historical trenches (284 samples). The first drilling program by O3 Mining was completed in winter 2023 with 15 drill holes totalling 7,344 metres and targeting low-mag features characteristic of the Marban Alliance and Norlartic deposits. The assay results from this program are pending.

The discovery by prospecting of a volcanogenic horizon with an exhalative appearance (named GP-2) in summer 2022 suggests the potential for VMS deposits in the northern part of the Horizon property. The decametric siliceous horizon contains 15% finely laminated pyrite and pyrrhotite, and a grab sample returned 0.7 % Cu, 0.5 g/t Au and 9.4 g/t Ag. The government’s geological maps indicate the presence of felsic volcanics in the area. Claims have been staked to cover the prospective belt to the northwest, up to Malartic Lake, to join O3 Mining’s Heva property. The latter has been since amalgamated into the Horizon project. A VTEM survey (370 km, 100 m spacing) was completed in December 2022, and an IP survey (pole-dipole and gradient) was completed over the winter. The surveys identified weak to moderate anomalies, one of which is 1 kilometre long and coincident with the GP-2 showing. Conceptually, these potential volcanogenic horizons could lead us to a VMS deposit below the VTEM penetration limit (approximately 250 m).

The planned 2H-2023 program will include completing the soil geochemistry coverage, stripping, and about 6,000 m of drilling to test soil geochemistry anomalies from the 2022 survey, extensions of historical intercepts, and the geophysical anomalies at and around the GP-2 showing.

Localization and timing of planned work

Overview

The Matachewan and Wydee properties lie to the east and west, respectively, of the town of Matachewan, Ontario, a historical gold mining town located at the western end of Ontario Highway 66 along the Montreal River. The town is located approximately 75 kilometres southeast of Timmins, Ontario and 60 kilometres southwest of Kirkland Lake, Ontario. Just three kilometres west of the town of Matachewan lies Alamos Gold Inc.’s Young-Davidson Mine, which has been in production since 2012.

The Matachewan property is comprised of 248 contiguous mining claims units encompassing 4,330.11 hectares and measures approximately eight by ten kilometres. The claims are 100% owned by O3 Mining. The Wydee property comprises 332 contiguous mining claims units encompassing 6,125 hectares and measures approximately eight by ten kilometres. The claims are 100% owned by O3 Mining.

Exploration history on the properties goes back to the 1950’s. More recently, from 2003 to 2009, Alexandria Minerals conducted a large bulk of work across the central portion of the property in Cairo Township. This included airborne magnetics and very low frequency- electromagnetics, ground magnetics and induced polarization surveys, and twelve diamond drill holes totalling 4,189.6 metres. In 2005 and 2009, following the geophysical survey results, eight holes were drilled to test various strong induced polarization/low magnetic anomalies on their main Matachewan Property north of Highway 66, both along the syenite sediment contact and within the mafic volcanics. In 2017 to 2020, Prosper Gold Corp. performed geological mapping, airborne geophysics and drilling under an option agreement with Alexandria. In 2020 the agreement was terminated and the property went back to Alexandria (100% O3 Mining subsidiary).

Geology and Mineralization

The Matachewan and Wydee Properties are located in the southwestern part of the Abitibi greenstone belt of the Superior Province near the town of Matachewan. The Abitibi greenstone belt is comprised of a complex and diverse sequence of volcanic, sedimentary, and plutonic rocks that are typically metamorphosed to greenschist facies, but locally attained amphibolite facies adjacent to large plutons.

The Larder Lake-Cadillac fault zone is the major deformation zone in the area and cuts across the Matachewan Property. The deformation zone contains several key characteristics: 1) a spatial association with ultramafic volcanic rocks; 2) a spatial association with conglomerate rocks; 3) a locus for carbonate alteration; 4) a spatial association with alkalic-shoshonitic igneous rocks; 5) a locus for highly strained rocks, shear zones and folds; and 6) a site of numerous gold deposits and occurrences (Poulsen, 2017).

Past and present producing gold mines in the Matachewan area are mainly contained within sheared and altered syenitic rocks, mafic volcanic flow and tuffs, and Timiskaming sedimentary rocks (Bernatchez, 2005). Most of the gold mined in the Matachewan area has been mined at the Young-Davidson deposit, which is considered a syenite-associated deposit.

Numerous mineral occurrences have been documented on the Matachewan and Wydee Properties. Historically, three styles of gold mineralization have been recognized, including syenite-hosted, mafic volcanic-hosted, and shear-zone hosted gold mineralization. Among them, the Carmax area is one of the most promising with historical cuts of 1.6 g/t Au over 9.0 m, 4.1 g/t Au over 1.5 m and 5.3 g/t Au over 1.5 m in hole MAT-08-07. These intercepts remain open along the 5km+ long associated IP anomaly flanking a magnetic unit.

Exploration by O3 Mining

Following thorough compilation work in 2022, a geological mapping program from October 19th to November 2nd, 2022, was conducted by Orix Geoscience Inc. for O3 Mining Inc. The purpose of the field program was to locate historical showings within the 5 areas of interest identified by the compilation, map the geology of the showings, and evaluate their potential for future exploration.

Plans for 2023-24 include detailed prospecting – mapping – sampling and soil geochem surveys over the areas of interest, induced polarization geophysical survey and 8,500 meters of drilling. The Carmax area is a ready to drill target to follow up on the Alexandria drill intercepts along the 5 km + associated geophysical anomaly.

Localization and timing of planned work

Overview

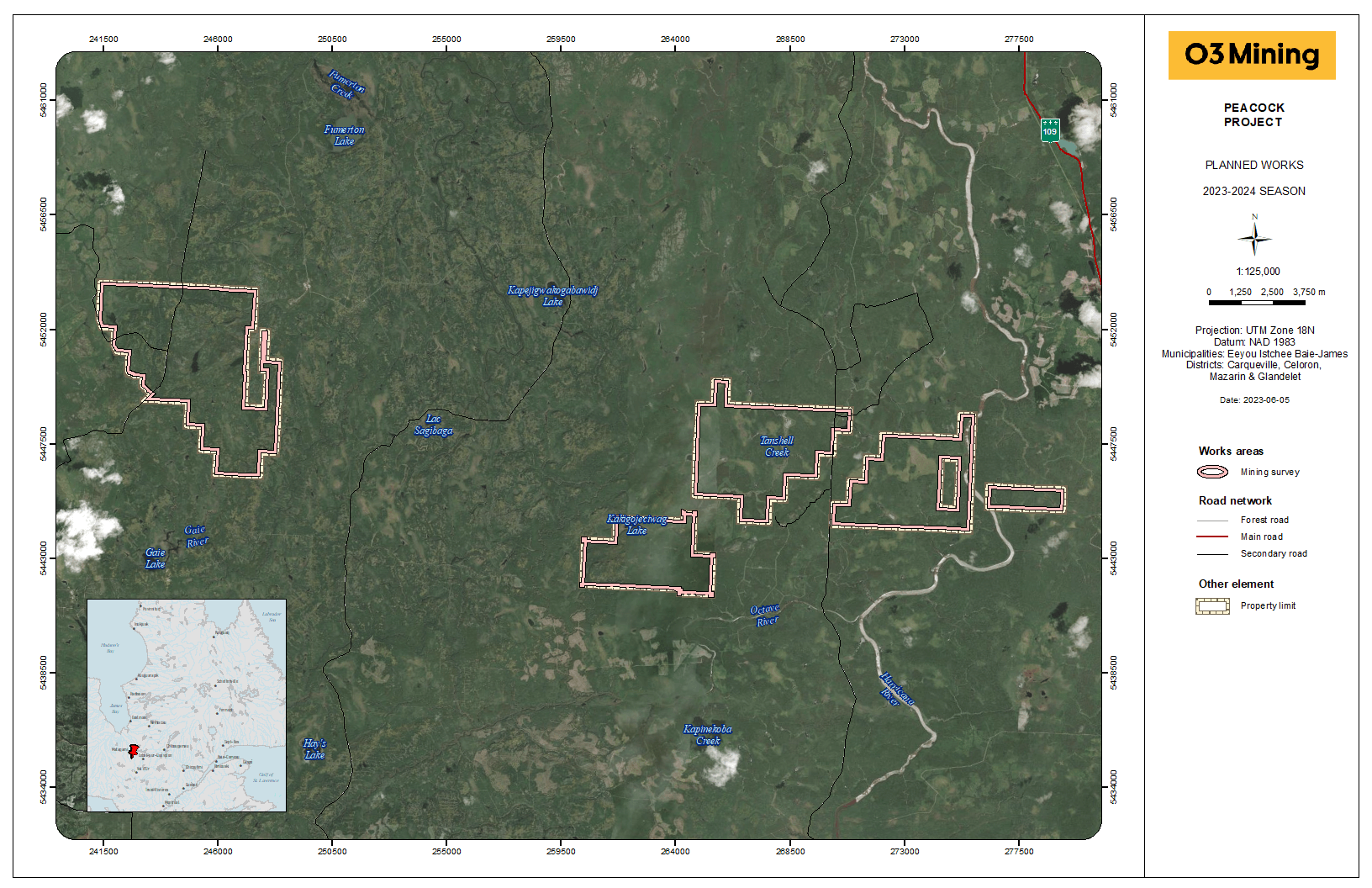

The Peacock property is located in the western portion of the province of Quebec, Canada, about 70 km north of the town of Amos and 40 km west of the Sleeping Giant Gold project from Mines Abcourt. It consists of 169 claims covering an area of 8,590 hectares distributed in two separate blocks. The property is easily accessible by a network of logging roads.

A wide variety of exploration work has been conducted on the Peacock property and its immediate surroundings since 1948. Much of this work consisted of compilation studies, trenching, stripping, sampling, geophysical surveys and drilling.

The areas host many projects that have reached an advanced exploration stage or even production. The gold potential of the region is notably illustrated by the Sleeping Giant gold mine (3,158,698 tons at 10.48 g/t Au) located 40 km east of the Peacock property. Between 2009 and 2012 Maudore Minerals Ltd. performed prospecting work on the Peacock property area. It consisted of prospecting, stripping, mapping and sampling. A total of 1,270 samples (including 179 economical samples and 1,091 lithological samples) were collected.

Geology and Mineralization

The Peacock property area lies within the east-central portion of the Abitibi Subprovince in the Superior Province of the Canadian Shield. This subprovince consists of a large Archean belt of volcano-plutonic rocks that extends more than 600 kilometres from Timmins in Ontario to Chibougamau in Québec. The belt is bordered to the north by granitic rocks of the Opatica Subprovince and to the south by sedimentary rocks of the Pontiac Subprovince. The southern limit of the Abitibi Subprovince is roughly marked by the Larder Lake—Cadillac Fault. It also happens to be one of the richest mining regions in the world and has produced large amounts of gold, copper, zinc, silver from Timmins, Kirkland Lake, Rouyn- Noranda, Val-d'Or, Matagami and Chibougamau mining districts.

The Peacock property area is mostly underlain by volcanic rocks. This sequence is characterized by mafic volcanism with superimposed felsic volcanics. The volcanic sequence is dominated by massive, pillowed and brecciated basalt of tholeiitic composition. Mafic volcanic rocks are intercalated with sedimentary and felsic volcanic rocks. Most of the volcanic episodes took place from 2.75 to 2.70 Ga and was closely followed by deformation, regional metamorphism and an episode of plutonism. Sedimentary assemblages occur as thin, discontinuous, east-trending belts more than 100 km in length. They are intercalated with volcanogenic conglomerates, banded iron formations, shales and cherts. The volcanic rocks were affected by the Kenorean north-south regional compression. This compression resulted in a well-developed E-W schistosity flowing around regional plutons.

A lithogeochemistry study of the areas reveals many felsic rocks on both blocks of the property. On the western block, field observations on historical stripping revealed a NW-SE orientation in the volcanic rocks near the contact with the Mistaouac Pluton. The first derivative component of the magnetic survey indicates that the overall orientation of the band of felsic rocks becomes more N-S moving southward. These felsic rocks extend to the north and could possibly be the stratigraphic equivalent of the felsic volcanic sequences hosting the Joutel base metal deposits some 30 km north of the Peacock west block. The Joutel district produced a total of 11.1 Mt of 2.0% Cu, 0.7% Zn and 6.2 g/t Ag out of two mines between 1966 and 1975.

The Peacock property shows potential for three (3) deposit types: volcanogenic massive sulphide, greenstone-hosted quartz-carbonate veins, and nickel-copper sulphide. On the Bieber showing grab samples returned up to 0.97% Cu. Prospecting also led to the discovery of significant Au, Ag, Cu and Mo values in a quartz veins (sample L230796: 1.3 g/t Au, 38.8 g/t Ag, 2130 ppm Cu and 2890 ppm Mo). Also, many other quartz veins were found on the Gaby stripping. The best results are in the following table:

Best assays from grab and channel samples on the stripping

Stripping Sample Assay Bieber L230796 1.245 g/t Au, 38.8 g/t Ag, 2130 ppm Cu and 2890 ppm Mo (grab) P231412 9680 ppm Cu (grab) L287460 1800 ppm Cu (grab) Gaby L287442 1180 ppm Cu over 0.7 m L287441 1250 ppm Cu over 0.7 m N174632 1620 p p m Cu over 0.6 m L287450 9380 ppm Cu (grab) N174641 28600 ppm Cu (grab) L287448 1.49 g/t Au (grab) L287449 2.18 g/t Au (grab) L287447 24.6 g/t Au (grab) L287438 0.79 g/t Au and 2670 ppm Cu (grab) L287474 0.9 g/t Au and 9930 ppm Cu (grab) N174082 1.32 g/t Au and 3820 ppm Cu (grab) L287439 3.49 g/t Au and 3280 ppm Cu (grab) N174644 4.05 g/t Au and 2890 ppm Cu (grab) (SourceMRNFQ: GM67555 page 34)

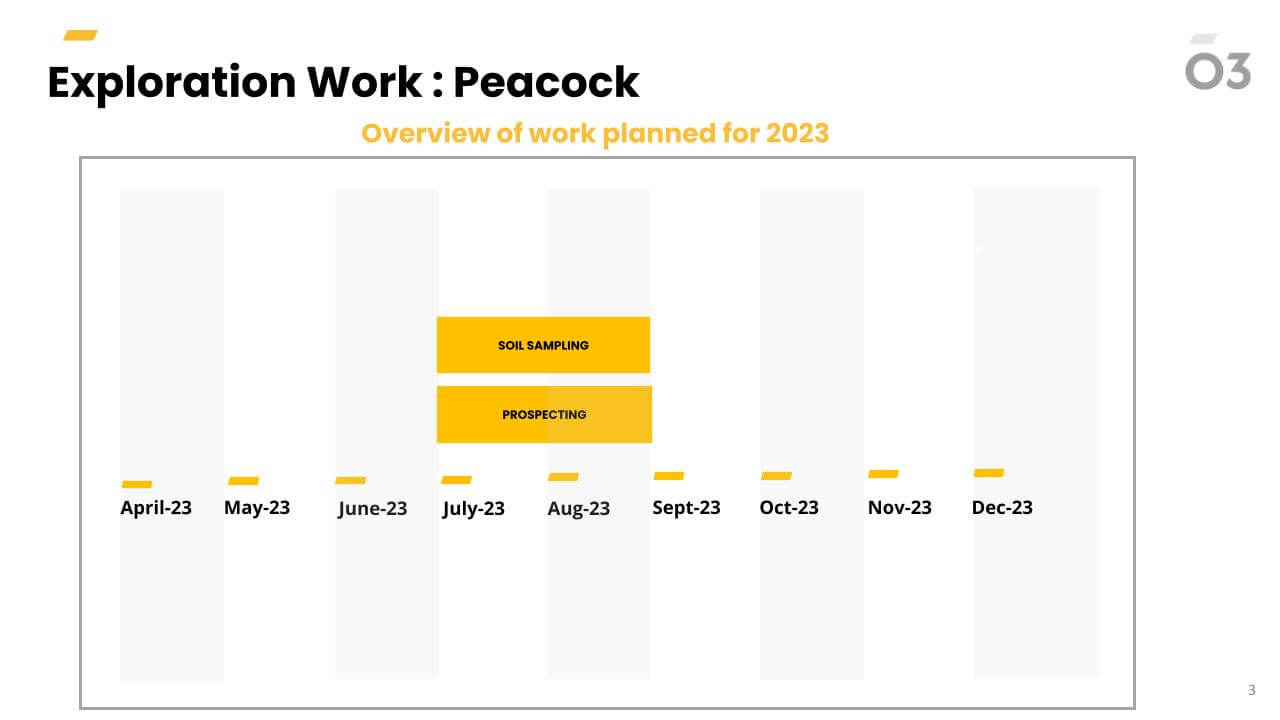

Exploration by O3 Mining

O3 Mining initiated compilation work in preparation for an initial summer field season aiming at understanding the mineralization context and assessing the potential for significant deposits on the property.

Localization and timing of planned work

Planned timeline for 2023

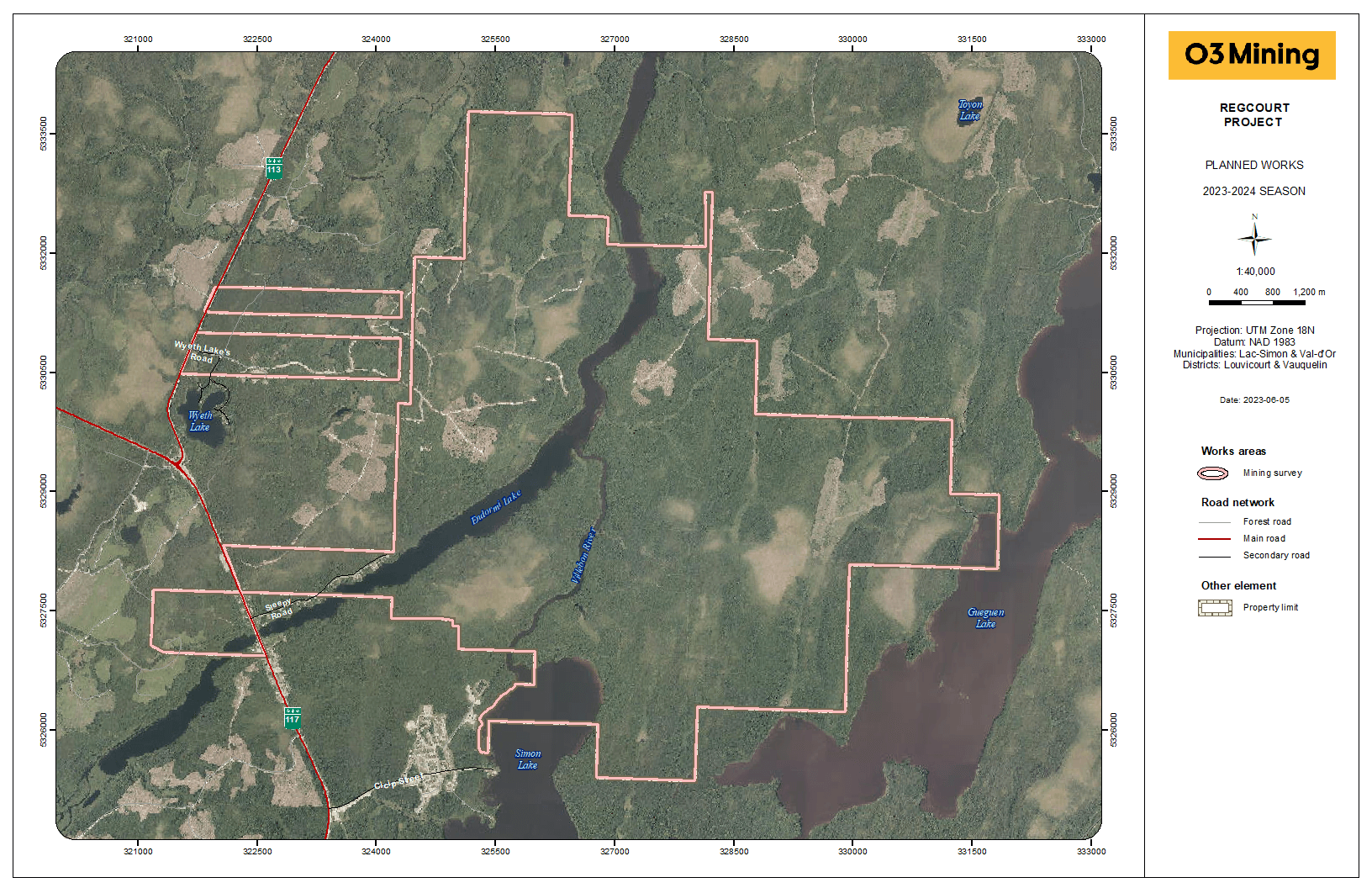

Overview

The Regcourt property comprises 89 claims and covers 2620 hectares (26 km2) in the eastern part of the Abitibi Greenstone Belt, 30 km east of Val-d’Or, Quebec. The Regcourt Mine deposit was discovered in 1944. During initial exploration, an area of outcrop in the vicinity of a granodiorite stock was stripped, exposing the main vein, which yielded an average gold grade of 8.13 gpt (grams per tonne) with an average width of 0.76 metres over a strike length of 67 metres. Underground development was carried out in 1946-47 and comprised a 544 ft shaft and 1317 ft of cross-cuts and drifts. Many surveys were completed on the property including : mapping, geochemistry, different types of geophysics, systematic RC drilling and wide spread diamond drilling. The Regcourt property, outside the Regcourt mine, went from hand to hand through the years and the shape of the property varied substantially. Exploration was carried out for base metals as well as for gold (same geological package as the Louvicourt base metal deposit located to the west).

Geology and Mineralization

The Regcourt mine is associated to a gold-bearing, fault-fill and extensional quartz-tourmaline-pyrite vein system, hosted in a small (200 m x 400 m) granodiorite intrusion. A shear zone that transects the granodiorite intrusion is documented in several historic holes and underground workings, and likely continues into the surrounding country rock. The style of deformation and mineralization at the historic Regcourt Mine deposit is consistent with other gold deposits in the Val-d’Or gold mining camp. The deposit contains a historic mineral inventory (not NI-43-101 compliant), in the vicinity of the shaft, of 61,000 tonnes Au @ 5.49 gpt (10,766 oz.), calculated to a depth of 500 ft (Routledge, 1983). Similarities between the gold mineralization at Regcourt and that of the nearby Beaufort Mine are recognized.

Exploration by O3 Mining

O3 Mining initiated compilation work in preparation for an initial summer field season aiming at understanding the mineralization context and assessing the potential for significant gold and base metal deposits on the property.

Localization and timing of planned work

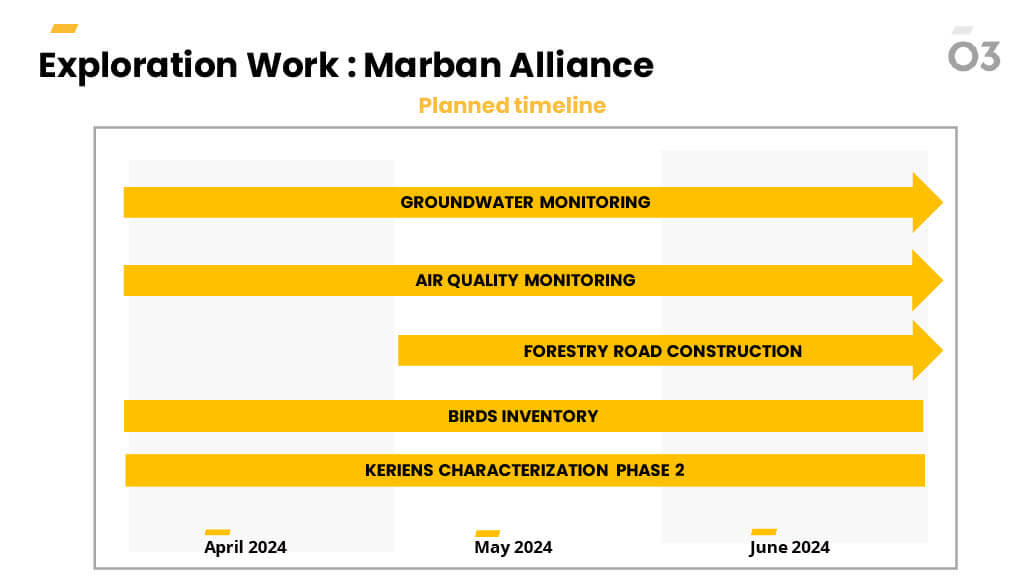

The Marban Alliance property is located in the western portion of the province of Quebec, Canada, midway between the towns of Val-d’Or and Malartic and is comprised of 65 mining claims covering 2,189 hectares. Exploration conducted at the Marban Alliance property apparently dates back to at least 1940 and includes geologic mapping, sampling, compilation of geological, structural, and geochemical data, geophysical prospecting, trenching, and extensive drilling from the surface and underground. At least 14 different companies explored and/or mined on parts of the property from 1940 through 2019 when O3 Mining was created. The deepest drill hole reached 1,475 vertical metres.